Navigating the World of Digital Payments: SEO Best Practices for Credit Card Firms

Overview of Digital Payments

In today’s fast-paced and digital world, the way we make payments has drastically transformed. Digital payments have revolutionized the credit card industry, providing consumers with convenience, security, and flexibility. With the rise of mobile banking and e-commerce platforms, credit card companies are capitalizing on the opportunities presented by this shift. To stay competitive in the market, credit card companies are incorporating various digital payment options, such as digital wallets, contactless payments, and mobile payment apps.

These digital payment methods allow users to make seamless and instant transactions, eliminating the need for physical cards or cash. Digital payments also offer enhanced security features, like biometric authentication and encryption, ensuring the safety of sensitive financial information. Additionally, credit card companies are leveraging advanced technologies like machine learning and AI to personalize user experiences and offer targeted financial products. The proliferation of digital payments has reshaped the landscape of the credit card industry, driving innovation, and providing a more convenient and secure way for consumers to manage their finances. In this article, we explore effective SEO strategies for credit card companies to stand out and connect with customers in the digital payments sphere.

SEO Strategies for Credit Card Firms

Research and Identity Keywords

When it comes to credit card firms, conducting keyword research is crucial for developing effective SEO strategies. In this case, we will focus specifically on Discover. There are several tools available to help with keyword research, such as Google Keyword Planner and SEMrush.

Google Keyword Planner is a free tool provided by Google that allows users to discover relevant keywords and obtain data on average monthly searches and competition levels. SEMrush is a paid tool that provides more detailed insights into keywords, including search volume, competition, and keyword difficulty.

When conducting keyword research, it is essential to target keywords that are both relevant to your content and have high search volume but low competition. By targeting relevant keywords, you can attract the right audience and improve your website’s visibility in search engine results.

For Discover credit card firms, some of the top relevant keywords include “Discover credit card,” “credit card issuer,” “credit card network,” “cash back rewards,” and “no annual fee.” These keywords reflect key features and offerings of Discover credit card services and are likely to be searched for by potential customers.

Optimize Internal Links

For credit card companies to increase the SEO and user experience of their websites, internal link optimization is essential. Credit card companies can boost user engagement, search engine exposure, and website navigation by carefully linking important sections inside the site.

Internal links direct users and search engines to various parts of the website. They act as a roadmap. Users are more inclined to investigate and uncover similar material when they come across pertinent internal connections. This enhances their entire experience and lengthens their stay on the website, indicating to search engines the value of the information.

Internal links aid search engine crawlers in comprehending the hierarchy and structure of a website from an SEO standpoint. Search engines are alerted to the importance of a page when it has several internal links to pertinent pages. Improved search engine rankings may result from this.

Additionally, employing pertinent anchor text and positioning internal links wisely aids search engines in deciphering the relevance and context of each page. Credit card companies might further optimize their website for targeted keywords by adding keywords into their anchor text.

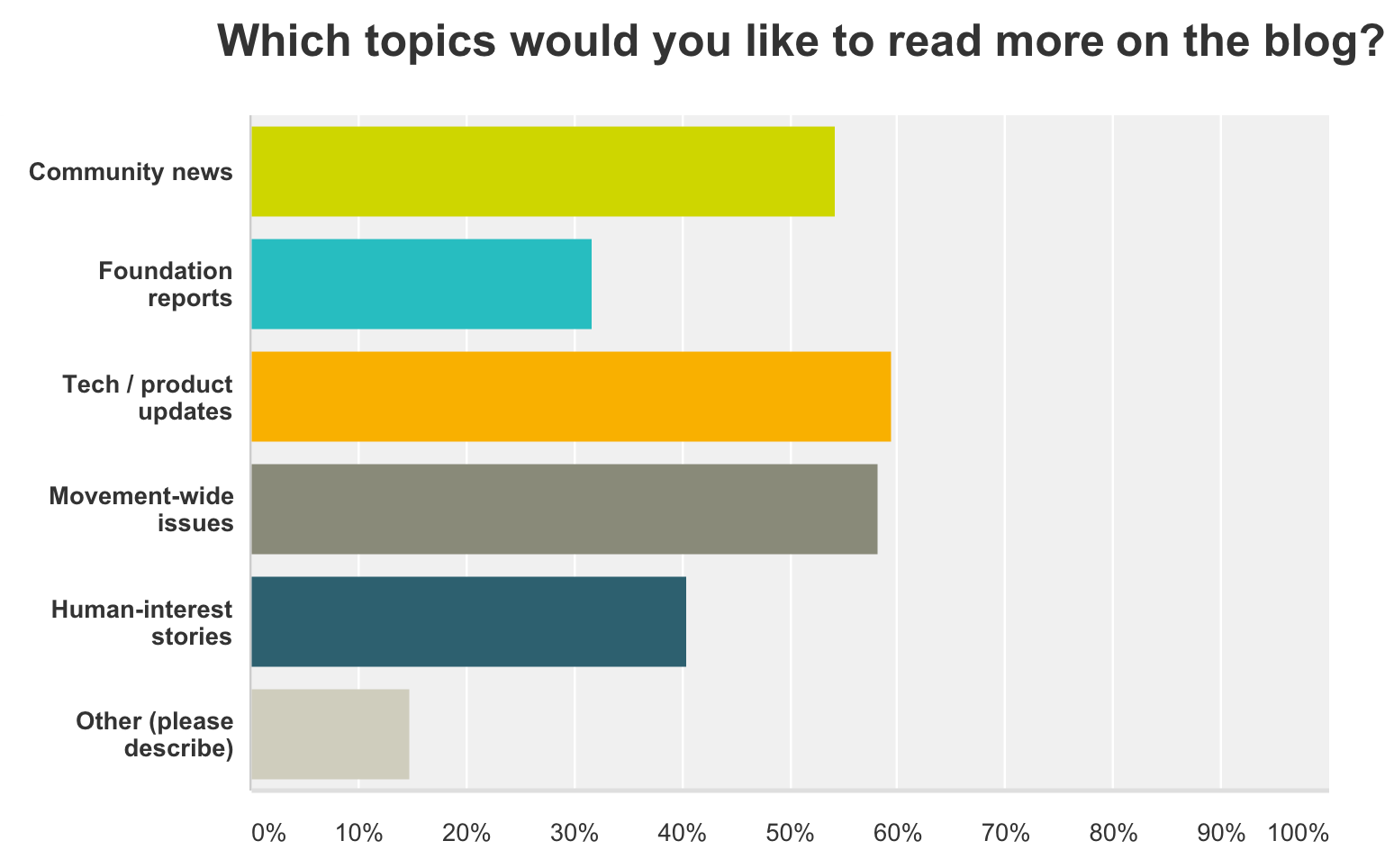

Utilize Relevant Content Types and Formats

Credit card firms can utilize various content types and formats to enhance their digital payment strategies. Incorporating these diverse content options is crucial for engaging and informing their target audience effectively.

- One popular content type is blog posts, which allow credit card firms to share detailed information about their services, benefits, and features. Blog posts can cover topics like credit card rewards, debt management tips, or the advantages of digital payments. Infographics are another effective format, as they visually communicate complex information concisely and appealingly. Infographics can showcase statistics, compare different credit card options, or explain payment processes.

- Videos are also powerful tools for credit card firms. They can create informative and engaging videos that demonstrate how to use their digital payment platforms, discuss new features or technologies, or share success stories of satisfied customers. Additionally, podcasts are gaining popularity and can be used to discuss financial topics, provide credit card advice, or interview industry experts.

- Lastly, social media content is essential for credit card firms to engage with their audience. They can create polls, share informative articles, run contests, or post customer testimonials to educate and entertain their followers.

Develop Quality Content with Unique Perspectives

To develop quality content with unique perspectives for credit card firms, thorough research and an understanding of the target audience are essential. By gaining insights into the needs, preferences, and pain points of credit card users, firms can craft content that resonates with them.

Creating content that sets the firm apart from competitors is vital in today’s saturated market. By offering unique perspectives, credit card firms can differentiate themselves and become trusted industry experts. This can be achieved by focusing on niche topics, providing in-depth analysis, or sharing expert opinions to deliver valuable insights to readers.

A variety of content types and formats can be utilized to captivate and educate the target audience. Blog posts are an effective way to share detailed information about credit card services, benefits, and features. Infographics visually communicate complex information in a concise and appealing manner. Videos can be used to demonstrate how to use a digital payment platform or discuss new features. Additionally, podcasts provide a platform to discuss financial topics or interview industry experts.

Leverage Social Media Platforms to Promote Content

Leveraging social media platforms is a powerful strategy for credit card firms to promote their content and engage with their target audience. By utilizing platforms such as Facebook, Instagram, and Twitter, credit card companies can effectively share informative and engaging posts related to digital payments and credit cards.

Engaging with the target audience is vital in building brand awareness and credibility. By responding to comments, answering queries, and asking thought-provoking questions, credit card firms can establish themselves as accessible and knowledgeable industry experts.

Creating shareable content is essential for expanding the reach and visibility of credit card companies. By offering unique perspectives on topics such as foreign transaction fees, different types of credit cards, pros and cons of business credit cards, co-branded credit cards, and managing balance transfers, credit card firms can attract attention and generate social media shares.

Partnering with influencers or relevant industry stakeholders can also boost the visibility of credit card content. Influencers can provide credible endorsements and create content that resonates with their followers, driving engagement and increasing brand exposure.

Monitor Performance Metrics to Track Progress

Monitoring performance metrics is crucial for credit card firms to track the progress of their SEO strategies. These metrics provide valuable insights into the effectiveness and impact of various SEO efforts, enabling firms to make data-driven decisions and optimize their online presence.

- One key aspect that performance metrics help track is website traffic. By monitoring the number of visitors and the sources driving traffic to their websites, credit card firms can gauge the success of their SEO campaigns. A steady increase in organic search traffic indicates that the firm’s SEO strategies are attracting potential customers and increasing brand visibility.

- Alongside website traffic, monitoring user engagement metrics is essential. Metrics such as bounce rates, time spent on site, and page views per session provide insights into how visitors are interacting with the website. If the bounce rate is high or the average time on site is low, it may indicate that the website content or user experience needs improvement. By analyzing these engagement metrics, credit card firms can identify opportunities to enhance user satisfaction and encourage longer visits.

- Additionally, tracking keyword rankings is crucial for optimizing SEO efforts. By monitoring the performance of target keywords, credit card firms can assess their visibility in search engine results pages. If certain keywords are not ranking well, firms can adjust their SEO strategies accordingly, such as optimizing content or refining keyword targeting.

Understanding Foreign Transaction Fees

Foreign transaction fees are charges imposed by credit card firms on purchases made outside the United States. These fees are typically a percentage of the transaction amount and can range from 1% to 3% of the total purchase.

For credit card firms, foreign transaction fees can have a significant impact on their business. With more and more customers traveling internationally or making purchases from foreign merchants, it has become essential for credit card companies to address the issue of foreign transaction fees.

Exploring Different Types of Credit Cards

Credit card companies offer a wide variety of credit cards to meet the diverse needs of consumers. These cards come with various features and benefits, making it essential for individuals to choose the one that aligns with their lifestyle and financial goals.

Rewards credit cards are popular choices among consumers who want to earn rewards for their spending. These cards often offer points, miles, or cash-back on purchases, which can be redeemed for travel, merchandise, or statement credits. Cash-back credit cards, on the other hand, provide a percentage of the amount spent as cash rewards.

Secured credit cards are designed for individuals with limited or poor credit history. They require a security deposit, which serves as collateral, and help consumers build or rebuild their credit. Travel credit cards are tailored for globetrotters and offer travel-related benefits such as airline miles, hotel discounts, and travel insurance.

Balance transfer cards enable individuals to transfer their existing credit card debt to a new card with a lower interest rate or a promotional 0% APR period. This allows users to save on interest and pay off their debt faster.

Cards for bad credit help individuals with poor credit scores improve their creditworthiness. These cards may have higher interest rates and fees but can be a stepping stone toward better credit.

Student credit cards are specifically designed for college students, offering benefits like rewards and low credit limits. Lastly, business credit cards cater to the needs of business owners, providing perks such as expense tracking, higher credit limits, and rewards on business-related spending.

Credit cards have grown in popularity due to their flexibility and convenience as they have developed over time. With the development of digital payments and payment technologies, credit cards are now the preferred payment option for a large number of customers. With so many credit card options, people may select the one that best suits their needs in terms of both lifestyle and finances, which makes it simpler to handle money and accrue benefits as they go.

How Do Credit Card Companies Determine Their APRs?

Credit card companies use a few different factors to determine the APR of your credit card. In order to assess this, they draw from your application information such as income, total debt, and payment history. Other data points taken into account are the current state of the economy and what other cards you currently have. Finally, they evaluate your credit score in order to gain an insight into how risky it might be to extend your credit.

Your credit score can be broken into 3 categories – Excellent (700+), Good (650-699), and Poor (under 650) – and each of these categories carries different rates for interest rates. Generally speaking, those with good or excellent credit will receive lower interest rates on their card than someone with poor credit. Each element is weighed against one another when determining the APR range and ultimately the finalized rate offered on your card. Credit card companies must balance offering customers low rates while also managing their risk and business profitability.

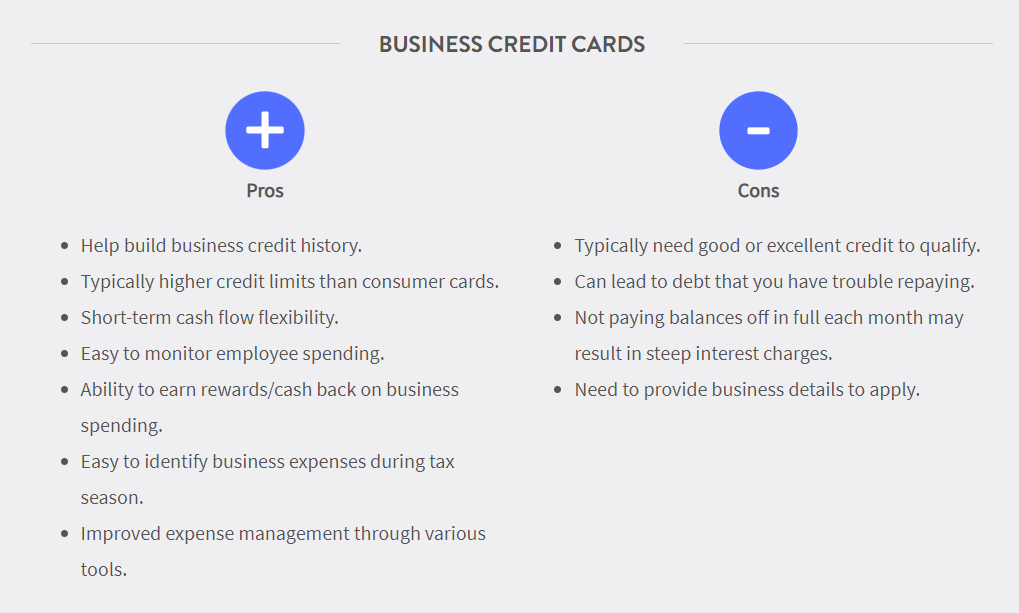

Analyzing the Pros and Cons of Business Credit Cards

For enterprises and entrepreneurs looking for simplified spending control and financial flexibility, business credit cards have become essential tools. But they have benefits and cons just like any other financial product. To assist you in determining whether business credit cards are appropriate for your needs, let’s examine the advantages and disadvantages of each.

Pros:

- Separation of Finances: Business credit cards offer a clear demarcation between personal and business expenses. This separation simplifies accounting, tax filing, and financial reporting.

- Expense Tracking: Most business credit cards provide detailed statements that categorize expenses, making it easier to monitor and track spending patterns. This aids in budgeting and financial planning.

- Financial Flexibility: Business credit cards provide a revolving credit line, enabling for businesses to cover unexpected expenses or manage cash flow gaps efficiently.

- Access to Rewards and Perks: Many business credit cards offer rewards programs tailored to business needs, such as cashback on office supplies, travel rewards, and discounts on business-related purchases.

- Employee Spending Control: With employee-specific cards and spending limits, business owners can delegate purchasing power while maintaining control over spending.

- Build Business Credit: Responsible use of a business credit card can help establish and improve your business credit score, which is crucial for obtaining favorable financing terms in the future.

Cons:

- Interest Rates: Business credit cards often have higher interest rates compared to other forms of financing. Carrying a balance can lead to significant interest costs over time.

- Potential Debt Accumulation: The ease of credit card spending can lead to overspending and accumulating debt, especially if not managed diligently.

- Personal Liability: Some business credit cards may require a personal guarantee, making the business owner personally liable for the debt in case of default.

- Annual Fees: While many business credit cards come with no annual fees, some premium cards may charge significant annual fees, affecting the overall cost-effectiveness.

- Complex Terms: Credit card agreements can be complex, with varying terms and conditions. Failure to understand these terms could lead to unexpected fees or penalties.

- Risk of Misuse: Delegating spending authority to employees can lead to misuse or unauthorized purchases if not carefully monitored.

Understanding Co-Branded Credit Cards

Co-branded credit cards are a popular feature in the credit card industry, offering unique benefits to both retailers and consumers. These cards are typically issued by a bank under a contract with a retailer or merchant, and they bear the name of the retailer or merchant.

Discussing How to Manage Balance Transfers

Managing balance transfers is an effective strategy for credit card users looking to consolidate their debts or take advantage of lower interest rates. By transferring credit card balances to a new card, individuals can potentially save money and simplify their monthly payments.

One of the primary benefits of balance transfers is the opportunity to reduce interest costs. Many credit card companies offer promotional periods with low or even 0% interest rates on transferred balances. By taking advantage of these offers, cardholders can save money on interest payments, allowing them to pay off their debts more quickly.

However, there are several considerations to keep in mind when managing balance transfers. First, it’s important to read the fine print and understand any fees associated with the transfer. Some cards may charge balance transfer fees, which can eat into the potential savings. Additionally, individuals should be mindful of the promotional period length and ensure they can pay off the transferred balance within that time frame to avoid high-interest charges.

People usually have to apply for a new credit card with a balance transfer function in order to start a balance transfer. The account numbers and balances of the cards they want to transfer, among other details, must be provided. After approval, the debt will be transferred to the new credit card and the amounts on the old cards will be paid off by the credit card issuer.

To effectively manage balance transfers, it’s essential to create a repayment plan and stick to it. This includes making regular payments and paying more than the minimum amount due, if possible. By diligently managing the transferred balance and paying it off within the promotional period, individuals can maximize the benefits of balance transfers and improve their overall financial situation.

Conclusion: Unleash the Power of SEO Expertise

In the dynamic digital landscape, the paramount importance of partnering with a proficient SEO agency cannot be overstressed. As businesses strive to establish their online presence and navigate the intricacies of search engine algorithms, this collaboration emerges as a strategic imperative. These agencies possess specialized expertise, ensuring optimal visibility, organic traffic, and engagement in the digital realm.

Staying ahead of industry trends and algorithm updates, SEO agencies adapt strategies to maintain search relevance. Their proficiency spans keyword optimization, content creation, link building, and website performance enhancement. Insights and data-driven approaches empower businesses, helping them attain a competitive edge. By entrusting SEO intricacies to experts, businesses can focus on core operations, secure in the knowledge that their digital presence is in capable hands. In an era where online visibility equals success, a partnership with an SEO agency becomes a pivotal investment propelling businesses towards heightened brand awareness, increased traffic, and sustained growth.

Baris Coskun

Baris Coskun is 8 years experienced SEO Expert that specializes in content and technical SEO strategy creation/implementation progress for large-scale, multilingual, and international targeting websites.