The Affluent Audience Online: How Wealth Management Firms Can Benefit from SEO

What is SEO and Wealth Management?

Search engine optimization (SEO) can be a powerful marketing tool for wealth management firms. SEO refers to improving a website’s visibility on search engines like Google. Wealth management companies can draw in more prospective customers who are actively looking for financial advisers and related services by improving their internet presence.

In this article, we will:

- Explore the benefits of SEO for wealth management firms and how it can help them increase organic traffic.

- Improve search engine rankings and ultimately generate more qualified leads. From understanding the importance of relevant keywords to optimizing user experience and leveraging various SEO strategies, we will delve into the key tactics that wealth management firms can employ to establish a solid online presence and effectively reach their target audience.

So let’s dive in and understand the SEO benefits for wealth management firms.

The Benefits of SEO for Wealth Management Firms

For wealth management companies, search engine optimization, or SEO, has several benefits. These businesses can obtain a competitive advantage and see significant financial gains by using SEO.

In the digital era, potential clients seek financial advisors and wealth management services via search engines. Effective SEO strategies ensure these firms appear prominently in search results for relevant keywords. This elevated visibility generates organic website traffic, translating to more qualified leads and potential clients.

An astonishing 92% of online sessions begin with a search engine, and Google handles over 3.5 billion daily searches alone. Firms that overlook optimization risk missing out on a vast pool of potential clients.

Putting money into SEO improves user experience by increasing websites’ accessibility and relevance to search terms. Wealth management companies attract and pique the interest of their target audience by improving title tags, meta descriptions, and pertinent content. Search engine rankings and the authority of websites are enhanced by the integration of both internal and external linking tactics.

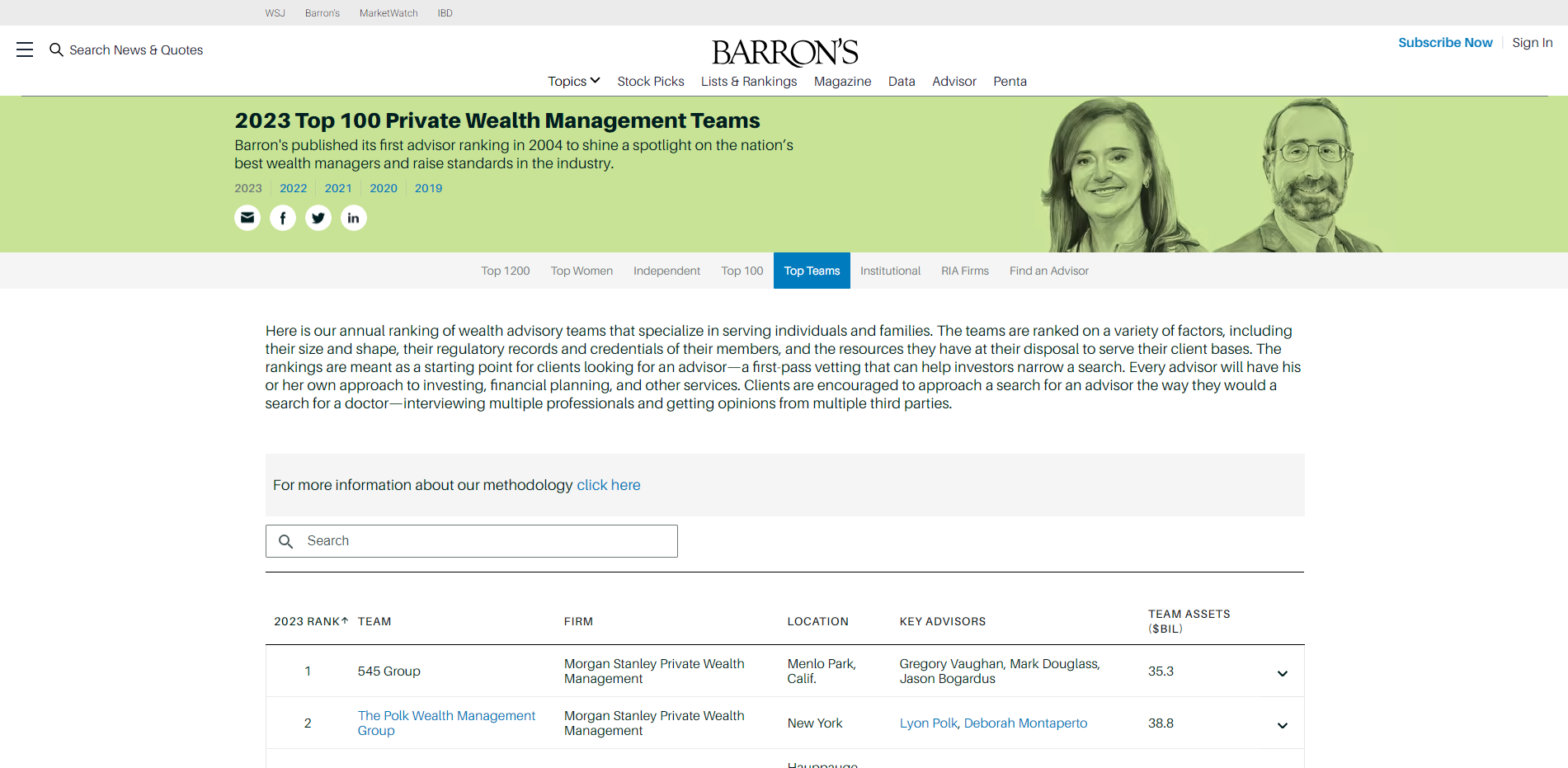

Source: barrons.com

Understanding the Affluent Audience Online

Wealth management firms must understand their behavior and preferences to target and engage with the affluent audience online effectively.

This audience expects a high level of personalized service and expertise, and they prioritize trust and credibility when selecting a financial advisor. Utilizing SEO strategies can help wealth management firms tailor their online presence to meet this affluent audience’s specific needs and interests.

Wealth management companies can discover the search terms and phrases that appeal to this population and tailor their website content by performing in-depth keyword research. Creating pertinent material that speaks to the particular problems and objectives of wealthy people will draw their interest and position the company as a reliable source of knowledge.

Additionally, wealth management companies can make sure they target this demographic efficiently and offer a consistent user experience across all devices by implementing SEO strategies like mobile optimization and local search. A wealth management company’s exposure and reputation can be greatly increased by comprehending the internet affluent audience and putting a focused SEO plan into place. This will eventually increase client acquisition and retention.

Who is the Affluent Audience?

Comprehending these characteristics and inclinations is crucial for wealth management firms seeking to effectively serve this profitable customer base. Businesses can effectively attract and maintain rich clientele by customizing their services and marketing initiatives to match these distinct needs.

- Diverse Affluent Demographics: The affluent audience is a heterogeneous group encompassing both millennials inheriting wealth and baby boomers who’ve accumulated riches over time. Their common goals are financial stability, growth, and long-term wealth management.

- Prioritizing Trust and Expertise: Trust and transparency are paramount for the affluent when choosing a wealth management company. They seek experts who can safeguard and grow their wealth efficiently.

- Efficiency for Busy Lifestyles: Many affluent individuals have busy professional lives, requiring streamlined financial management strategies that save time and maximize returns.

- Values-Driven Investments: The affluent audience often seeks investments aligned with their values, such as socially responsible or impact-driven choices.

- Digital Convenience: Convenience is a key factor, with a preference for digital platforms and mobile applications for managing their finances effectively.

How do They Search for Financial Advisors?

The wealthy clientele looks for qualified financial advisors using internet resources and platforms. They mostly use search engines, such as Google, Bing, and Yahoo, to find what they’re looking for. They type in terms like “wealth management firms” or “financial advisors.” For advice and insights, social networking sites like Facebook, Twitter, and LinkedIn are essential. They search their networks for recommendations, testimonies, and reviews.

Industry-specific websites dedicated to financial planning and wealth management are valuable resources. These sites offer comprehensive advisor information. Firms with a solid online presence on these platforms can attract many potential clients.

Referral networks are also crucial for the affluent audience searching for financial advisors. They rely on recommendations and endorsements from their peers, colleagues, and other professionals in their network who have had positive experiences with a particular advisor.

Understanding their online behavior and preferences, wealth management firms should ensure they have a strong presence on search engines, maintain active and engaging profiles on social media platforms, establish a reputable company on industry-specific websites, and actively participate in referral networks to increase their visibility and attract affluent audiences.

What Keywords Should be Targeted?

When crafting a successful SEO strategy for wealth management firms, it’s vital to pinpoint and focus on the right keywords. This begins by understanding what terms the target audience is actively searching for.

Start by considering key areas like popular investment options such as ETFs, Cryptocurrency, Equities, and Commodities. Wealth management firms can better connect with their audience and establish expertise in these fields by aiming for these specific keywords.

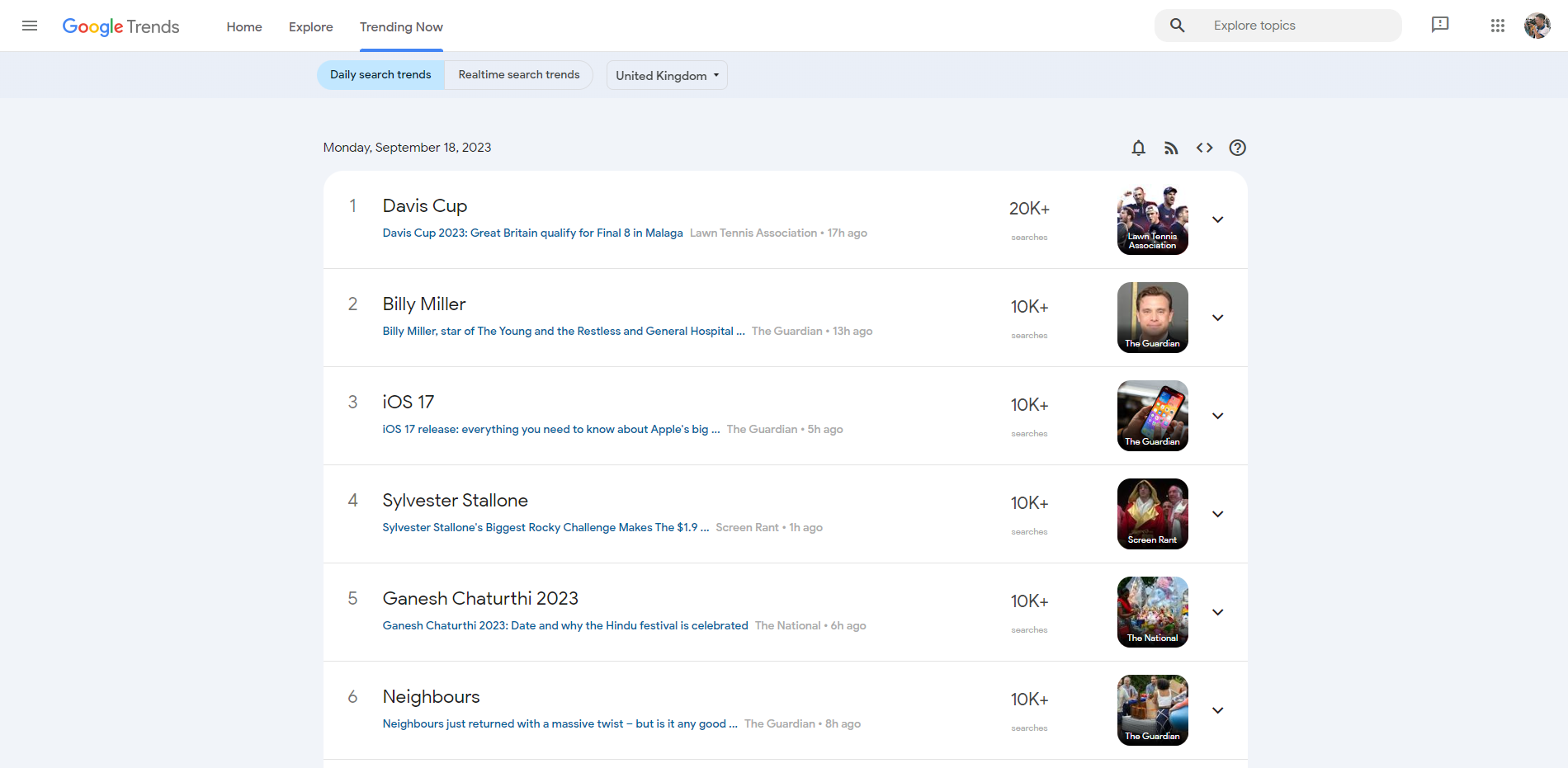

Tools like Google Trends are valuable for gauging keyword popularity. Analyzing search volume and trends helps asset managers identify sought-after keywords. This insight shapes content and SEO strategies, allowing firms to create engaging content that resonates with the audience’s interests and needs.

What are Their Online Habits & Behaviors?

The affluent audience, consisting of high-net-worth individuals seeking wealth management services, has specific online habits and behaviors to consider when creating an effective SEO strategy.

Regarding their preferred devices, the affluent audience tends to rely heavily on mobile devices, such as smartphones and tablets, for their online activities. They appreciate being able to access information and services on the go, making it crucial for wealth management firms to have mobile-friendly websites and strategies.

Regarding browsing patterns, this audience tends to be proactive in conducting thorough research before making any financial decisions. They often visit multiple websites, read blog posts, and watch educational videos to gather information about potential advisors and investment opportunities. This presents an opportunity for wealth management firms to create engaging and informative content that caters to their needs.

Social media usage is another essential aspect to consider. While the affluent audience may spend little time on social media platforms, they still utilize them to stay informed and connect with like-minded individuals. Wealth management firms can leverage social media channels to share valuable content and engage with their target audience.

When it comes to user experience, the affluent audience has high expectations. They appreciate sleek and intuitive website designs that are easy to navigate. They also expect a personalized experience tailored to their financial goals and preferences.

Creating a successful SEO strategy requires an understanding of the online behaviors and habits of the affluent audience. Wealth management companies may get into a better position to draw in and cater to this important target group by producing interesting content, making their website mobile-friendly, and offering a comfortable user experience.

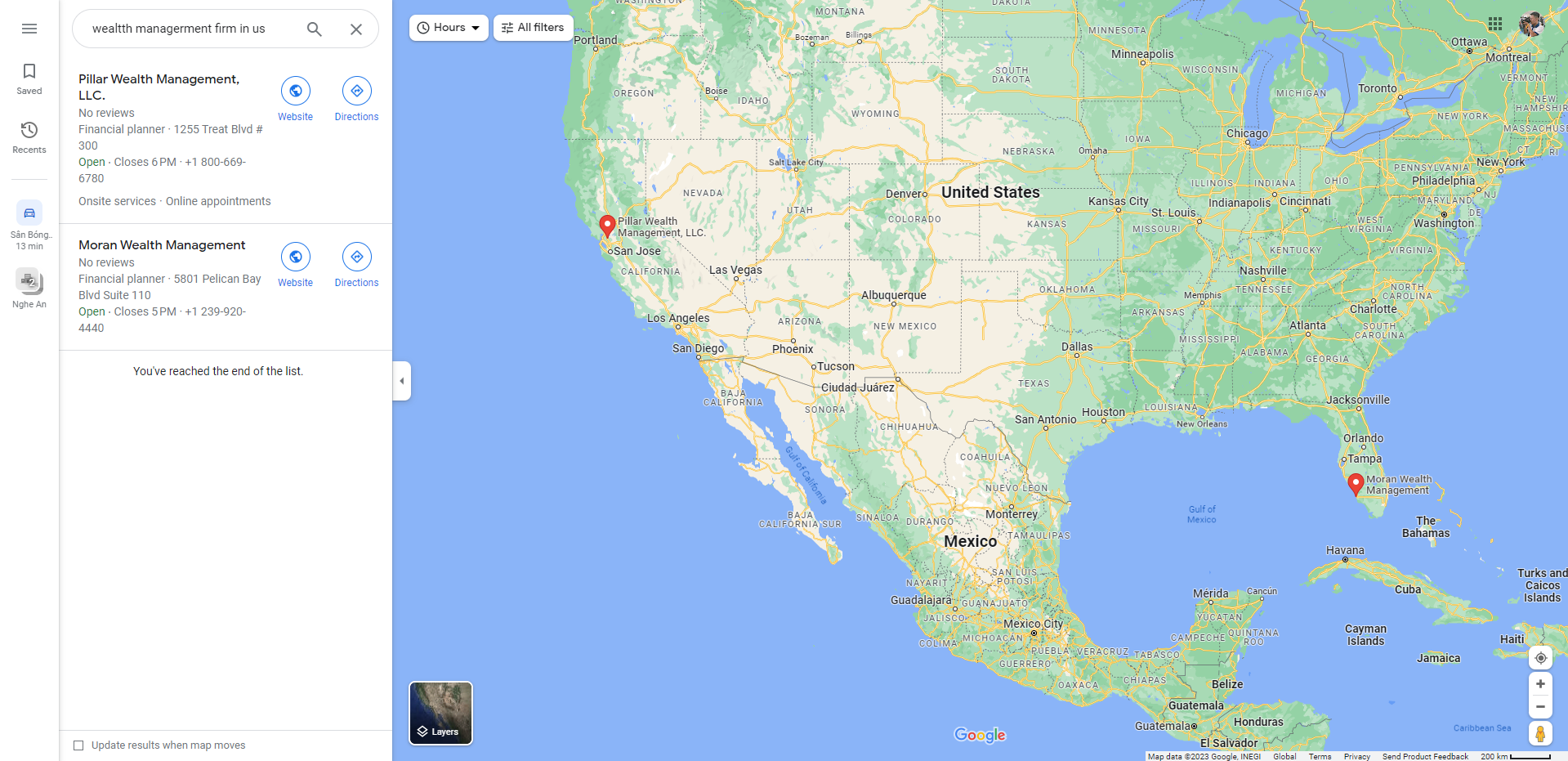

Utilizing Google My Business to Reach the Affluent Market

In today’s digital world, online presence is crucial for all businesses, including wealth management firms. Google My Business is a powerful tool that lets businesses manage their information, photos, and reviews on Google. Wealth management firms can use Google My Business to increase their visibility and effectively reach the affluent market.

Why Google My Business is Essential for Reaching Target Clients

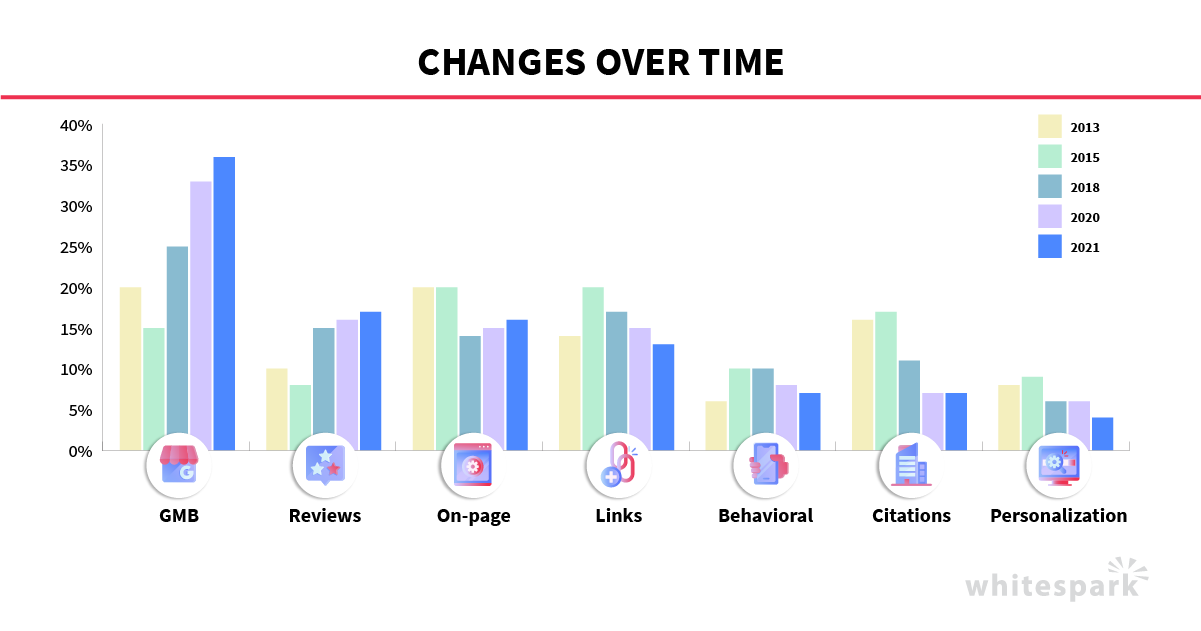

Google My Business(GMB) is a must-have tool for wealth management firms aiming to effectively connect with their target clients. A robust online presence is vital as most potential clients use search engines to find financial advisors. GMB provides a potent marketing tool that boosts firms’ visibility and draws potential clients in.

Wealth management companies can emphasize offerings, contact information, and locations by creating and refining a GMB profile. This increases the firm’s likelihood of showing up in local search results and helps prospective clients locate it more quickly.

Moreover, Google My Business fosters trust and credibility. Verified listings with positive reviews and ratings bolster clients’ confidence. The platform also permits responses to client reviews, deepening engagement and faith.

Utilizing the tool offers insights into user preferences via Google Analytics, aiding firms in tailoring marketing strategies.

All things considered, Google My Business is very important for asset management companies. It helps to build reputation, draw in new customers, and increase visibility. Businesses can effectively interact with their target audience and generate quality leads by using this platform.

Setting Up Your GMB Account & Optimizing It for Maximum Visibility

To create a GMB account, go to Google My Business and follow the steps to set up a new account. After making the account, optimize it for better visibility.

First, make sure to claim your GMB listing for your firm. This gives you control over the information displayed, like business hours and contact details. Accurate info helps potential clients find and contact you quickly. Adding photos to your GMB listing can significantly enhance your online presence. Visual content engages clients and showcases your firm. Include professional photos of your office, team, and other relevant images.

Setting up and optimizing your GMB account can boost your online visibility and attract more potential clients. Take advantage of this chance to showcase your firm to a broader audience.

Generating Reviews on GMB to Build Trust & Credibility

Positive reviews on Google My Business (GMB) can be crucial in building trust and credibility for wealth management firms. They serve as an influential factor for potential clients and impact your search engine rankings. Here are steps to generate reviews on GMB and practical strategies to leverage them:

Step 1: Encourage Clients to Leave Reviews

- Ask satisfied clients to share their positive experiences with your firm on GMB. Personalize your request, explaining how their reviews can help others make informed decisions. Emphasize the importance of feedback and how it can contribute to your firm’s growth.

Step 2: Make Leaving Reviews Easy

- Provide clear instructions for clients to leave reviews on GMB. Include a direct link to your GMB profile or guide them through the process on your website or email communications. Making it convenient for clients to leave reviews increases their likelihood of doing so.

Step 3: Respond to Reviews

- Show your clients you value their feedback by promptly responding to positive and negative reviews. Thank clients for their kind words, addressing concerns, and demonstrating your commitment to excellent client service. This engagement reflects your attentiveness and care, further building trust.

Step 4: Monitor and Manage Reviews

- Keep a regular eye out for fresh reviews on your GMB page and take prompt action to resolve any concerns. You may improve the reputation of your company and demonstrate your commitment to client happiness by handling and answering reviews immediately.

- Positive reviews on GMB build trust and credibility for wealth management firms. They provide social proof and influence potential clients’ decision-making process. By generating reviews, responding to them, and effectively managing them, your wealth management firm can establish a robust online presence and attract more potential clients.

Source: hootsuite.com

Leveraging GMB Insights to Monitor Performance & Results

Monitoring the SEO effectiveness of your wealth management company requires that you use GMB Insights. By routinely reviewing key performance indicators, you may assess the effectiveness of your efforts and adjust as necessary.

- One thing to watch is your keyword rankings. GMB Insights tells you what words potential clients use to find your firm. By keeping an eye on these rankings, you can see which words bring the most people to your site and adjust your content accordingly.

- Checking how many people find your firm through organic search is also essential. GMB Insights shows this organic traffic. By seeing how it changes over time, you can tell if your SEO is doing well and spot areas to improve.

- Another significant number is the click-through rate (CTR). GMB Insights tells you how often people click on your listing in search results. This lets you see if your title tags, meta descriptions, and content work effectively.

- It’s also helpful to look at exit rates. If many people quickly leave your site after visiting, it might mean there needs to be an issue with your design or content. Fixing these problems can keep visitors engaged and boost conversions.

- Lastly, keep an eye on backlinks. GMB Insights can show you links from other sites to yours. These links affect how search engines see your site. More links from reputable sites can increase search rankings and organic traffic.

Enhancing Organic Search with a Comprehensive SEO Strategy

To increase their online presence, wealth management companies must have a solid SEO plan. These businesses can draw in more customers by ranking higher in search engine results for their website and content.

Crafting an Effective SEO Strategy to Reach High-Net-Worth Individuals

High-net-worth individuals(HNWIs) have unique online habits when looking for financial services. Effectively reaching out to these people is pivotal for your SEO strategy.

To ensure a website gets noticed and offers a great user experience, thorough keyword research is vital. Using keywords like “wealth management for high-net-worth individuals” can bring in organic traffic from potential clients.

Top-notch, relevant content is essential for engaging HNWIs. Articles, blogs, and guides can showcase expertise and address their specific financial needs. Optimizing title tags and meta descriptions with these keywords improves search engine rankings and attracts quality leads.

Boosting a website’s credibility and visibility requires solid backlinks. Teaming with industry experts and contributing to reputable financial websites can catch HNWIs’ attention.

Implementing schema markup is crucial for search engines to understand website content. This leads to better search rankings and visibility. To sum it up, an effective SEO plan for wealth management firms targeting HNWIs involves:

- Thorough keyword research.

- Creating great content.

- Optimizing title tags and meta descriptions.

- Building strong backlinks.

- Using schema markup.

These strategies help attract high-net-worth individuals effectively.

Optimizing Site Content & Structure for Maximum User Experience and Search Engines

To achieve the best user experience, create relevant and captivating content that addresses your audience’s needs.

Begin with keyword research to find the most fitting keywords for your wealth management firm. Use these keywords naturally throughout your content, like headings and body text. Avoid overusing keywords, as they can harm user experience and search rankings.

Consider your website’s structure and user navigation. Use clear menus and internal links to guide users to relevant information and keep them engaged.

Optimize title tags and meta descriptions with targeted keywords to boost search engine rankings and attract quality leads. These elements provide a snapshot of your content in search results, so make them concise and accurate.

Regularly analyze your website’s performance with tools like Google Analytics. Identify high bounce rates and enhance user experience on those pages.

Following these on-page SEO practices can enhance your site’s content and structure for better user experiences and improved visibility on search engines.

Exploring the Role of SEO Agencies in Digital Success

In conclusion, the digital landscape has become a paramount arena for wealth management firms to connect with their affluent audience. The strategies outlined in this guide demonstrate how SEO can be a powerful ally in this endeavor. By leveraging SEO techniques tailored to their industry, wealth management firms can not only increase their online visibility but also establish credibility and trust with their target clientele.

Moreover, the implementation of SEO strategies enables these firms to stay agile in a dynamic and competitive market. As financial services continue to evolve, embracing SEO as an integral part of their digital marketing toolkit positions wealth management firms to not only thrive in the present but also to navigate the evolving landscape of the financial industry with confidence and authority. In harnessing the potential of SEO, these firms can effectively reach, engage, and serve their affluent audience, fostering enduring client relationships and sustained growth in the digital era.

Baris Coskun

Baris Coskun is 8 years experienced SEO Expert that specializes in content and technical SEO strategy creation/implementation progress for large-scale, multilingual, and international targeting websites.