Cultivating Investor Relationships Online: Growth Tactics for Private Equity Entities

Definition of Private Equity

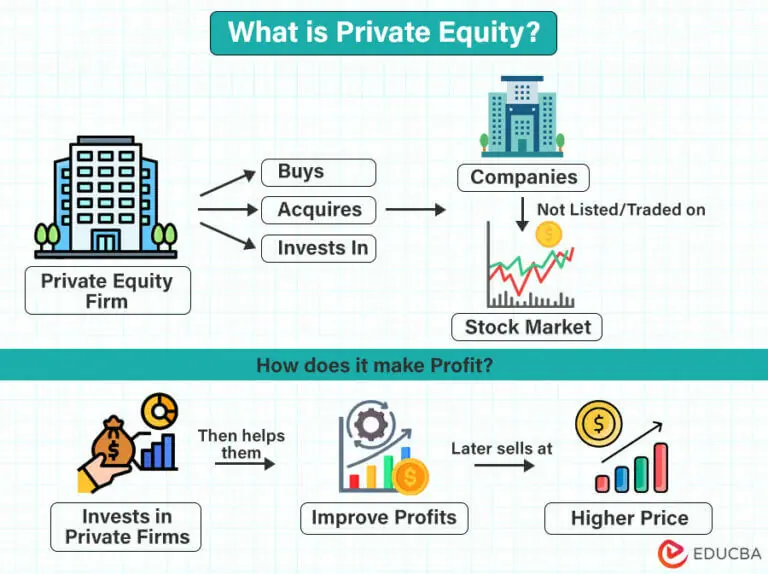

Private equity refers to a type of investment strategy where funds are pooled from various sources, such as institutional investors and high-net-worth individuals, to acquire stakes in privately-held companies. Unlike public companies, which trade their stocks on the stock market, private equity investments are made in private companies or in publicly-traded companies that are taken private through a leveraged buyout. Growth strategies for private equity entities often involve enhancing the value of these acquired companies through various means, such as operational improvements, strategic expansions, and market repositioning, ultimately aiming to increase profitability and achieve substantial returns on investment.

Private equity firms typically seek to add value to their portfolio companies by providing capital, strategic guidance, and operational expertise, with the aim of driving growth and maximizing returns. The growth strategies employed by private equity entities can include expanding into new markets, pursuing add-on acquisitions, improving operational efficiency, and increasing market share. These strategies are often implemented over a defined holding period, during which the private equity firm actively manages the investment before eventually exiting for a profit.

Source: https://www.educba.com/what-is-private-equity/

Benefits of Cultivating Investor Relationships Online

Cultivating investor relationships online can provide private equity entities with a significant competitive advantage in the alternative investment market. By embracing digital platforms and online communication tools, private equity firms can harness a range of benefits.

- Firstly, online investor relationship cultivation improves accessibility to a wider pool of potential investors. With a digital presence, private equity entities can connect with investors from various geographical locations and tap into new markets. This expanded reach increases the chances of attracting diverse investors and diversifying the investor base.

- Secondly, online communication and transparency create stronger relationships with investors. Through regular updates, reports, and interactive platforms, private equity firms can engage in meaningful conversations, addressing investor concerns and sharing information in a timely manner. This transparency builds trust and credibility, fostering long-lasting relationships.

- Another advantage is the increased visibility and brand awareness that comes with online investor relationship cultivation. By delivering relevant content and thought leadership, private equity entities can position themselves as industry experts and gain attention from potential investors. This enhanced visibility enables firms to stand out in a crowded market and attract top-tier investors.

- Lastly, online platforms provide the ability to track and analyze investor engagement. Private equity entities can measure the effectiveness of their online communication efforts, gaining insights into investor preferences, interests, and behavior. This data-driven approach allows for targeted and personalized communication, improving overall investor satisfaction.

Types of Private Equity Entities

Private equity entities can take various forms, each with its own unique characteristics and investment strategies. The types of private equity entities include venture capital firms, growth equity firms, and buyout firms. Venture capital firms focus on early-stage investments in high-growth startups and provide capital in exchange for equity. Growth equity firms invest in more mature companies with the aim of accelerating their growth.

Venture Capital Firms

Venture capital firms play a significant role within the private equity industry by focusing on investing in startup and high-risk businesses. Unlike other private equity firms that generally target more established companies, venture capital firms are particularly interested in fast-growing industries with high growth potential.

Venture capital financing typically occurs in different stages. In the seed stage, funds are provided to support the initial development and idea validation of a startup. This is followed by the early stage, where investments are made to help the company build its product or service and establish its market presence. Finally, in the late stage, venture capital firms provide capital to support the expansion and scaling of a business that has already demonstrated significant growth potential.

Venture capital firms bring both financial and non-financial resources to the table for their portfolio companies. They often provide guidance and mentorship to the management teams of the startups they invest in, helping them navigate the challenges of building and scaling a business. The ultimate goal of venture capital firms is to generate substantial returns on their investments through successful exits, such as initial public offerings or acquisitions.

Source: https://dealroom.net/faq/pe-fund-structure

Leveraged Buyouts

In the world of private equity, leveraged buyouts (LBOs) are a commonly used strategy to acquire companies. In an LBO, a private equity firm purchases a company by using a significant amount of debt, known as debt instruments, as collateral. This means that the majority of the funds used to acquire the company are borrowed, with the acquired company’s assets serving as collateral for the debt.

The goal of an LBO is not just to acquire a company, but also to restructure it in a way that drives growth and increases its value. Once the acquisition is complete, the private equity firm takes control of the company and works closely with its management team to identify areas for improvement and implement strategic changes. These changes may include streamlining operations, optimizing the capital structure, introducing new management practices, or pursuing add-on acquisitions to further expand the business.

Growth Equity Funds

Growth Equity Funds play a vital role in providing expansion capital to companies that have already established traction in their respective markets but require additional funds to reach the next level of growth. These funds are specifically designed to support companies during their growth phase, as they transition from early-stage to more mature entities.

During this growth phase, companies typically shift their focus towards profitability, aiming to optimize their financial profile. Key performance indicators (KPIs) become crucial in measuring and tracking the company’s success and growth potential. This includes metrics like revenue growth, customer retention, and cash flow management.

Growth Equity Funds understand the importance of these stages of growth and provide the necessary capital to fuel expansion plans. With their expertise and financial support, companies can implement strategic initiatives, such as geographic expansion, product diversification, or scaling sales and marketing efforts.

Mezzanine Funds

Mezzanine Funds play a significant role in private equity investments and offer a unique financing option for companies seeking expansion capital. These funds act as a bridge between debt and equity financing, providing a flexible and versatile funding solution.

Mezzanine funds provide capital to private companies in the form of subordinated debt or preferred equity. This means that they offer a combination of both debt and equity financing. The debt component carries a higher interest rate than traditional bank loans, while the equity portion gives the fund the opportunity to participate in the company’s growth and potential upside.

Private companies often turn to mezzanine funds when they require additional capital for expansion initiatives, such as geographic expansion, launching new products or services, or making strategic acquisitions. Unlike traditional lenders, mezzanine funds are more tolerant of higher leverage ratios and accept a higher level of risk. In return, they seek higher returns on their investment, making mezzanine funds an attractive option for companies with significant growth potential.

Mezzanine funds typically have a longer investment horizon than other types of financing options, aligning with the private equity investment strategy. They may also offer more flexibility in repayment terms and structures, allowing companies to allocate capital more effectively for growth.

Strategies for Growing Private Equity Investor Relationships Online

In today’s digital age, establishing and nurturing strong relationships with private equity investors online is essential for the success and growth of private equity entities. With the vast range of online platforms and tools available, private equity firms can implement various strategies to enhance their presence, engagement, and credibility with investors.

Establishing a Professional Website and Social Media Presence

Establishing a professional website and strong social media presence is crucial for private equity entities. In today’s digital age, having an online presence is essential for businesses to connect with stakeholders and investors effectively.

A professional website serves as a platform to showcase a private equity firm’s expertise and track record. It allows potential investors to learn more about the firm’s investment strategy, team members, and portfolio companies. By providing detailed information about past successes and industry experience, the website establishes credibility and attracts the attention of potential investors.

Social media platforms such as LinkedIn and Twitter can be powerful tools for private equity entities to engage with investors, share industry insights, and build brand awareness. Through regular posts and updates, firms can stay top-of-mind with investors, demonstrating their knowledge and thought leadership. Additionally, social media interactions facilitate direct engagement with both existing and potential investors, allowing firms to address inquiries and maintain open lines of communication.

Utilizing Search Engine Optimization Tactics

Utilizing search engine optimization (SEO) tactics is crucial for private equity firms looking to grow their investor relationships online. SEO strategies help increase online visibility, attract target investors, and generate valuable leads for the firm.

By conducting keyword research, private equity entities can identify the specific terms and phrases potential investors are searching for online. This information allows firms to optimize their website and content to appear higher in search engine results pages, making it easier for investors to find them.

- Website optimization involves incorporating relevant keywords into meta tags, headings, and content. This helps search engines understand the firm’s expertise and the value they provide. Additionally, having a user-friendly website design and fast loading times can improve the overall user experience, encouraging visitors to stay longer and explore the firm’s offerings.

- Content creation is another essential component of SEO. By consistently publishing high-quality and informative content, such as blog posts and white papers, private equity firms can establish themselves as industry experts. This not only helps attract organic traffic to their website but also builds trust and credibility with potential investors.

- Link building is another tactic that can improve SEO. By obtaining backlinks from reputable websites and industry publications, private equity firms can enhance their online authority and increase visibility in search engine rankings.

- Tracking analytics is crucial to measure the effectiveness of SEO strategies. By analyzing website traffic, keyword rankings, and conversion rates, private equity entities can identify areas for improvement and make data-driven decisions to optimize their online presence.

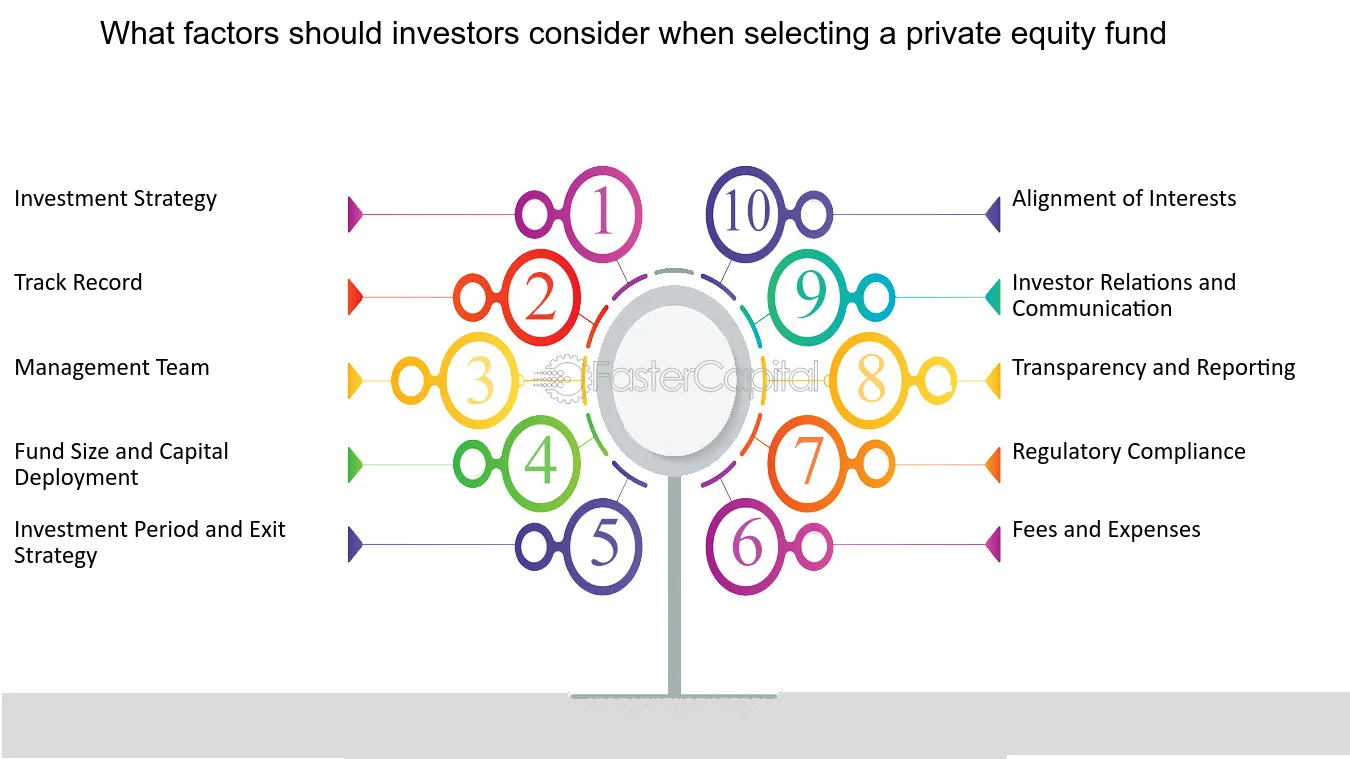

Source: https://fastercapital.com

Developing Strategic Partnerships with Other Investment Professionals

Developing strategic partnerships with other investment professionals is crucial in the private equity industry. These collaborations provide valuable opportunities for private equity entities to expand their investor relationships and gain access to new investment opportunities.

By partnering with other investment professionals, private equity firms can tap into their networks and reach a wider audience of potential investors. This not only helps to diversify their investor base but also increases their credibility and reputation within the industry.

Strategic partnerships also offer the benefit of shared expertise and resources. By collaborating with other professionals who have specialized knowledge or experience in specific industries or geographies, private equity entities can leverage their partner’s expertise to make more informed investment decisions. Additionally, pooling resources and sharing deal flow can lead to increased efficiency and a broader scope of investment options.

In the competitive private equity landscape, partnerships can provide a competitive edge. By combining forces with other investment professionals, private equity firms can enhance their ability to source and execute deals, ultimately leading to better investment performance.

Building Trust Within the Investment Community through Transparency

Building trust within the investment community is crucial for private equity firms as it helps establish their reputation and credibility. One of the key ways to build trust is through transparency. By providing clear and accurate information about their investments and operations, private equity firms can instill confidence in their investors and stakeholders.

Transparency in private equity involves openness and clarity about the firm’s investment strategies, portfolio companies, performance metrics, and risk management practices. It means providing regular and detailed reporting on the financial performance of investments, as well as updates on any material developments. It also includes disclosing the fees and expenses associated with fund management.

By being transparent, private equity firms demonstrate their commitment to accountability and responsible stewardship of investor capital. This transparency helps investors make informed decisions, understand the risks and opportunities associated with their investments, and evaluate the firm’s performance over time. Moreover, it provides investors with confidence that their interests are being protected and that the firm operates with integrity.

The benefits of transparency extend beyond building trust. It can also aid in attracting and retaining investors. Investors value firms that are open and communicative about their investment strategies and operations. Clear information helps investors understand the firm’s approach and align their investment goals with the firm’s. Additionally, transparency can provide comfort to limited partners and institutional investors who place a premium on adherence to best practices and regulatory compliance.

Taking Advantage of Networking Opportunities on Digital Platforms

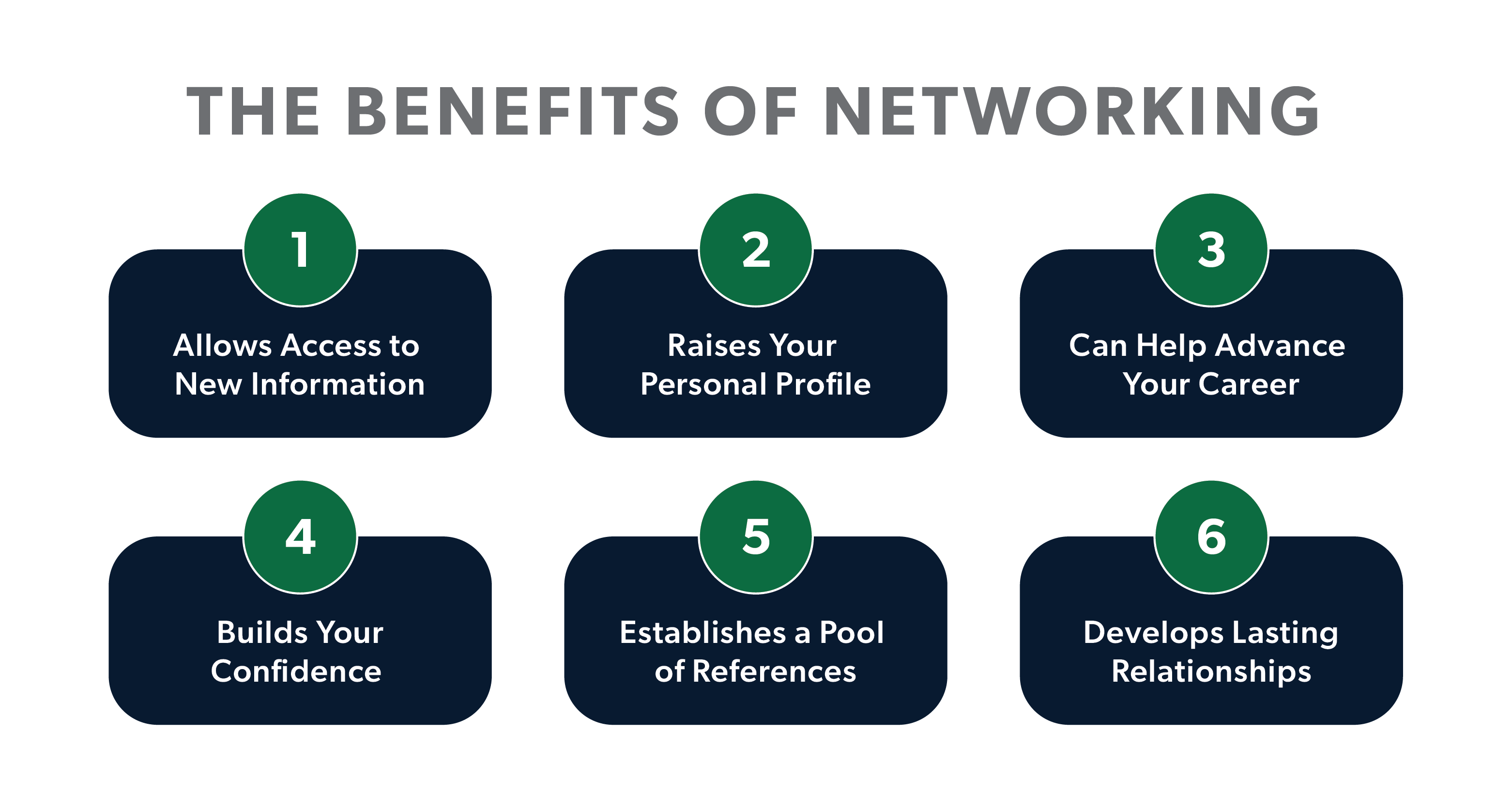

Private equity entities can take advantage of numerous networking opportunities on digital platforms to connect with potential investors, portfolio companies, and other industry professionals. These platforms provide a centralized space for networking and offer several benefits to private equity firms.

- One of the main advantages of utilizing networking opportunities on digital platforms is the ability to expand reach. Online platforms have a global reach, allowing private equity entities to connect with investors and companies from around the world. This can significantly increase the pool of potential investors and portfolio companies that a firm can access.

- Additionally, digital platforms provide a convenient and efficient way for private equity entities to connect with industry professionals. These platforms often have features such as search filters and recommendation algorithms that help firms find relevant connections. Private equity managers can use these tools to identify potential investors who have specific investment preferences or sector expertise, as well as connect with industry professionals for collaboration or knowledge-sharing.

- Another benefit of networking on digital platforms is the ability to access proprietary deals. Many online platforms offer private investment opportunities that are not publicly available. By actively participating in digital networking activities, private equity entities can gain access to exclusive deal flow and uncover potential investment opportunities that they may not have otherwise found.

Source: https://www.astoncarter.com

Challenges and Considerations for Growing Investor Relationships Online

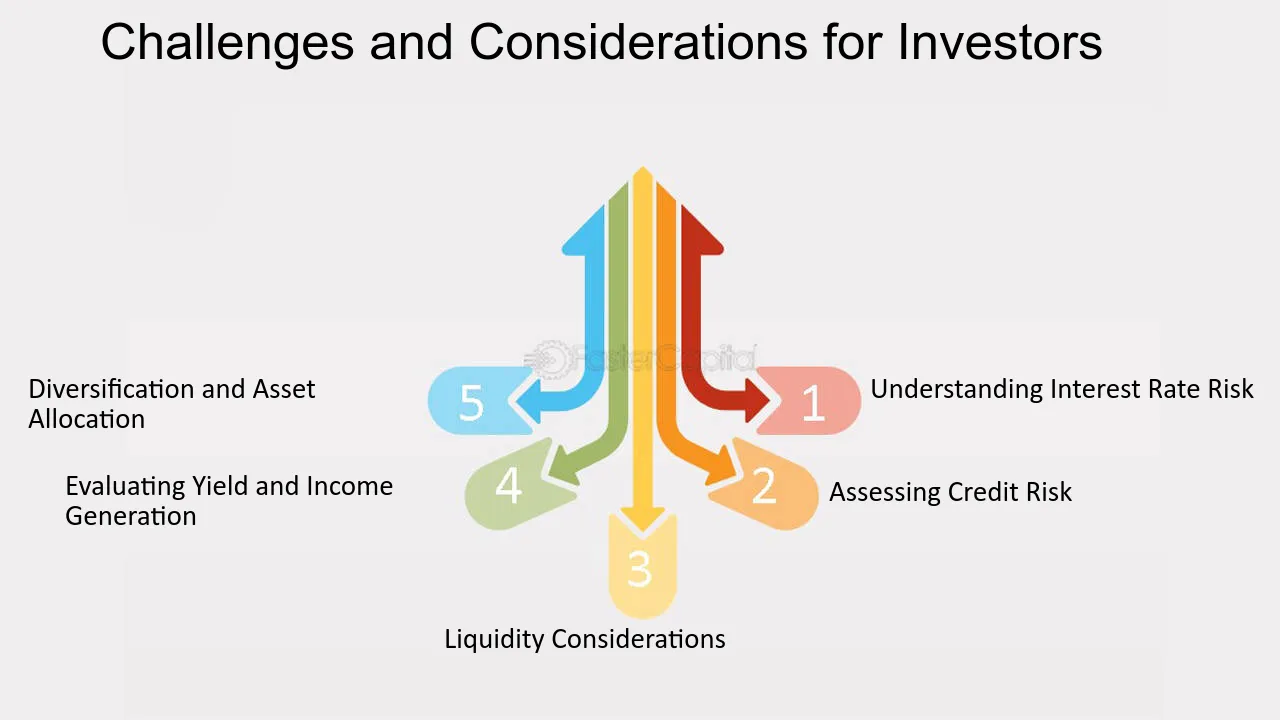

Building and maintaining strong investor relationships is crucial for private equity entities looking to raise funds and secure investments. While networking on digital platforms offers many advantages, there are also challenges and considerations to keep in mind.

Legal and Regulatory Challenges with Digital Marketing Strategies

Legal and regulatory challenges can arise when implementing digital marketing strategies in the private equity industry. These challenges can impact the growth of investor relationships online and have significant consequences if not properly addressed.

Private equity entities engaging in digital marketing activities should be aware of specific regulations and laws to ensure compliance. These include laws related to advertising, investor protection, data privacy, and anti-spam regulations.

Advertising regulations require private equity firms to provide accurate and non-deceptive information about their offerings, ensuring transparency for investors. Investor protection laws aim to safeguard the interests of individuals and institutional investors, imposing disclosure requirements and prohibiting fraudulent practices.

Data privacy regulations, such as the General Data Protection Regulation (GDPR), dictate how private equity firms can collect, store, and process personal data of investors and potential clients. Stricter consent and data management practices need to be implemented to comply with these regulations.

Anti-spam regulations, such as the CAN-SPAM Act, govern email marketing activities in the private equity industry. Private equity firms must adhere to opt-in and opt-out requirements, provide clear identification in their emails, and honor unsubscribe requests.

To ensure compliance with these regulations, private equity entities should implement best practices. These include conducting regular audits of their digital marketing activities, seeking legal counsel when necessary, maintaining updated privacy policies and consent processes, and providing clear and accurate information to investors.

Source: https://fastercapital.com

The SEO Agency Impact: A Closer Look at Your Options

Hiring a top SEO consultant can bring numerous benefits to private equity entities looking to optimize their online presence and stay ahead in today’s competitive landscape. These experts possess the expertise and experience needed to enhance visibility, drive traffic, and ultimately cultivate profitable investor relationships.

Contact a top SEO consultant today to unlock the full potential of your online presence and capitalize on the networking opportunities available in the private equity industry. With their expertise, you can achieve higher visibility, attract more private equity investors, and establish a strong foothold in the stock market.

Baris Coskun

Baris Coskun is 8 years experienced SEO Expert that specializes in content and technical SEO strategy creation/implementation progress for large-scale, multilingual, and international targeting websites.